Getting the (Digital) Indo-Pacific Economic Framework Right

The article was originally published in Directions on 16 September 2022.

It is still early days. Given the broad and noncommittal scope of the economic arrangement, it is unlikely that the IPEF will lead to a trade deal among members in the short run. Instead, experts believe that this new arrangement is designed to serve as a ‘framework or starting point’ for members to cooperate on geo-economic issues relevant to the Indo-Pacific, buoyed in no small part by the United States’ desire to make up lost ground and counter Chinese economic influence in the region.

United States Trade Representative (USTR) Katherine Tai has underscored the relevance of the Indo-Pacific digital economy to the US agenda with the IPEF. She has emphasized the importance of collaboratively addressing key connectivity and technology challenges, including standards on cross-border data flows, data localisation and online privacy, as well as the discriminatory and unethical use of artificial intelligence. This is an ambitious agenda given the divergence among members in terms of technological advancement, domestic policy preferences and international negotiating stances at digital trade forums. There is a significant risk that imposing external standards or values on this evolving and politically-contested digital economy landscape will not work, and may even undermine the core potential of the IPEF in the Indo-Pacific. This post evaluates the domestic policy preferences and strategic interests of the Framework’s member states, and how the IPEF can navigate key points of divergence in order to achieve meaningful outcomes.

State of domestic digital policy among IPEF members

Data localisation is a core point of divergence in global digital policymaking. It continues to dominate discourse and trigger dissent at all international trade forums, including the World Trade Organization. IPEF members have a range of domestic mandates restricting cross-border flows, which vary in scope, format and rigidity (see table below). Most countries only have a conditional data localisation requirement, meaning data can only be transferred to countries where it is accorded an equivalent level of protection – unless the individual whose data is being transferred consents to said transfer. Australia and the United States have sectoral localisation requirements for health and defence data respectively. India presently has multiple sectoral data localisation requirements. In particular, a 2018 Reserve Bank of India (RBI) directive imposed strict local storage requirements along with a 24-hour window for foreign processing of payments data generated in India. The RBI imposed a moratorium on the issuance of new cards by several US-based card companies until compliance issues with the data localisation directive were resolved. Furthermore, several iterations of India’s recently withdrawn Personal Data Protection Bill contained localisation requirements for some categories of personal data.

Indonesia and Vietnam have diluted the scopes of their data localisation mandates to apply, respectively, only to companies providing public services and to companies not complying with other local laws. These dilutions may have occurred in response to concerted pushback from foreign technology companies operating in these countries. In addition to sectoral restrictions on the transfer of geospatial data, South Korea retains several procedural checks on cross-border flows, including formalities regarding providing notice to individual users.

Moving onto another issue flagged by USTR Tai, while all IPEF members recognise the right to information privacy at an overarching or constitutional level, the legal and policy contours of data protection are at different stages of evolution in different countries. Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore and Thailand have data protection frameworks in place. Data protection frameworks in India and Brunei are under consultation. Notably, the US does not have a comprehensive federal framework on data privacy, although there are patchworks of data privacy regulations at both the federal and state levels.

Regulation and strategic thinking on artificial intelligence (AI) are also at varying levels of development among IPEF members. India has produced a slew of policy papers on Responsible Artificial Intelligence. The most recent policy paper published by NITI AAYOG (the Indian government’s think tank) refers to constitutional values and endorses a risk-based approach to AI regulation, much like that adopted by the EU. The US National Security Commission on Artificial Intelligence (NSCAI), chaired by Google CEO Eric Schmidt, expressed concerns about the US ceding AI leadership ground to China. The NSCAI’s final report emphasised the need for US leadership of a ‘coalition of democracies’ as an alternative to China’s autocratic and control-oriented model. Singapore has also made key strides on trusted AI, launching A.I. verify – the world’s first AI Governance Testing Framework for companies that wish to demonstrate their use of responsible AI through a minimum verifiable product.

IPEF and pipe dreams of digital trade

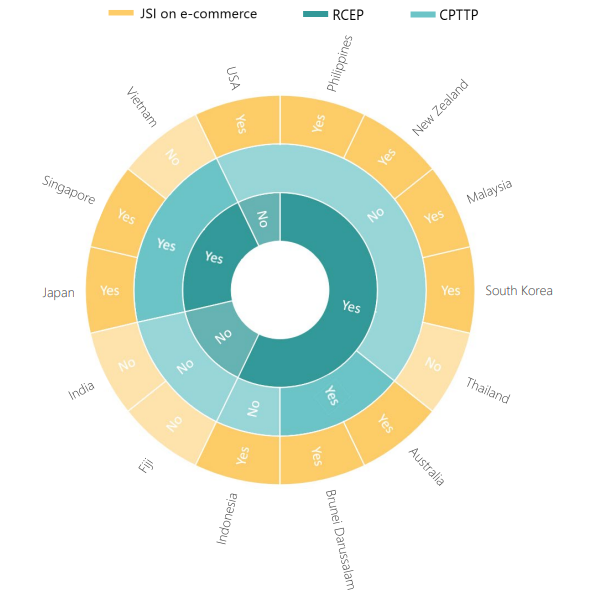

Some members of the IPEF are signatories to other regional trade agreements. With the exception of Fiji, India and the US, all the IPEF countries are members of the Regional Comprehensive Economic Partnership (RCEP), which also includes China. Five IPEF member countries are also members of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) that President Trump backed out of in 2017. Several IPEF members also have bilateral or trilateral trading agreements among themselves, an example being the Digital Economic Partnership Agreement (DEPA) between Singapore, New Zealand and Chile.

All these ‘mega-regional’ trading agreements contain provisions on data flows, including prohibitions on domestic legal provisions that mandate local computing facilities or restrict cross-border data transfers. Notably, these agreements also incorporate exceptions to these rules. The CPTPP includes within its ambit an exception on the grounds of ‘legitimate public policy objectives’ of the member, while the RCEP incorporates an additional exception for ‘essential security interests’.

IPEF members are also spearheading multilateral efforts related to the digital economy: Australia, Japan and Singapore are working as convenors of the plurilateral Joint Statement Initiative (JSI) at the World Trade Organization (WTO), which counts 86 WTO members as parties. India (along with South Africa) vehemently opposes this plurilateral push on the grounds that the WTO is a multilateral forum functioning on consensus and a plurilateral trade agreement should not be negotiated within the aegis of the WTO. They fear, rightly, that such gambits close out the domestic policy space, especially for evolving digital economy regimes where keen debate and contestation exist among domestic stakeholders. While wary of the implications of the JSI, other IPEF members, such as Indonesia, have cautiously joined the initiative to ensure that they have a voice at the table.

It is unlikely that the IPEF will lead to a digital trade arrangement in the short run. Policymaking on issues as complex as the digital economy that must respond to specific social, economic and (geo)political realities cannot be steamrolled through external trade agreements. For instance, after the Los Angeles Ministerial India opted out of the IPEF trade pillar citing both India’s evolving domestic legislative framework on data and privacy as well as a broader lack of consensus among IPEF members on several issues, including digital trade. Commerce Minister Piyush Goyal explained that India would wait for the “final contours” of the digital trade track to emerge before making any commitments.

Besides, brokering a trade agreement through the IPEF runs a risk of redundancy. Already, there exists a ‘spaghetti bowl’ of regional trading agreements that IPEF members can choose from, in addition to forming bilateral trade ties with each other.

This is why Washington has been clear about calling the IPEF an ‘economic arrangement’ and not a trade agreement. Membership does not imply any legal obligations. Rather than duplicating ongoing efforts or setting unrealistic targets, the IPEF is an opportunity for all players to shape conversations, share best practices and reach compromises, which could feed back into ongoing efforts to negotiate trade deals. For example, several members of RCEP have domestic data localisation mandates that do not violate trade deals because the agreement carves out exceptions that legitimise domestic policy decisions. Exchanges on how these exceptions work in future trade agreements could be a part of the IPEF arrangement and nudge states towards framing digital trade negotiations through other channels, including at the WTO. Furthermore, states like Singapore that have launched AI self-governance mechanisms could share best practices on how these mechanisms were developed as well as evaluations of how they have helped policy goals be met. And these exchanges shouldn’t be limited to existing IPEF members. If the forum works well, countries that share strategic interests in the region with IPEF members, including, most notably, the European Union, may also want to get involved and further develop partnerships in the region.

Countering China

Talking shop on digital trade should certainly not be the only objective of the IPEF. The US has made it clear that they want the message emanating from the IPEF ‘to be heard in Beijing’. Indeed, the IPEF offers an opportunity for the reassertion of US economic interests in a region where President Trump’s withdrawal from the CPTPP has left a vacuum for China to fill. Accordingly, it is no surprise that the IPEF has representation from several regions of the Indo-Pacific: South Asia, Southeast Asia and the Pacific.

This should be an urgent policy priority for all IPEF members. Since its initial announcement in 2015, the Digital Silk Road (DSR), the digital arm of China’s Belt and Road Initiative, has spearheaded massive investments by the Chinese private sector (allegedly under close control of the Chinese state) in e-commerce, fintech, smart cities, data centres, fibre optic cables and telecom networks. This expansion has also happened in the Indo-Pacific, unhampered by China’s aggressive geopolitical posturing in the region through maritime land grabs in the South China Sea. With the exception of Vietnam, which remains wary of China’s economic expansionism, countries in Southeast Asia welcome Chinese investments, extolling their developmental benefits. Several IPEF members – including Indonesia, Malaysia and Singapore – have associations with Chinese private sector companies, predominantly Huawei and ZTE. A study evaluating Indonesia’s response to such investments indicates that while they are aware of the risks posed by Chinese infrastructure, their calculus remains unaltered: development and capacity building remain their primary focuses. Furthermore, on the specific question of surveillance, given evidence of other countries such as the US and Australia also using digital infrastructure for surveillance, the threat from China is not perceived as a unique risk.

Setting expectations and approaches

Still, the risks of excessive dependence on one country for the development of digital infrastructure are well known. While the IPEF cannot realistically expect to displace the DSR, it can be utilised to provide countries with alternatives. This can only be done by issuing carrots rather than sticks. A US narrative extolling ‘digital democracy’ is unlikely to gain traction in a region characterised by a diversity of political systems that is focused on economic and development needs. At the same time, an excessive focus on thorny domestic policy issues – such as data localisation and the pipe dream of yet another mega-regional trade deal – could risk derailing the geo-economic benefits of the IPEF.

Instead, the IPEF must focus on capacity building, training and private sector investment in infrastructure across the Indo-Pacific. The US must position itself as a geopolitically reliable ally, interested in the overall stability of the digital Indo-Pacific, beyond its own economic or policy preferences. This applies equally to other external actors, like the EU, who may be interested in engaging with or shaping the digital economic landscape in the Indo-Pacific.

Countering Chinese economic influence and complementing security agendas set through other fora – such as the Quadrilateral Security Dialogue – should be the primary objective of the IPEF. It is crucial that unrealistic ambitions seeking convergence on values or domestic policy do not undermine strategic interests and dilute the immense potential of the IPEF in catalysing a more competitive and secure digital Indo-Pacific.

Table: Domestic policy positions on data localisation and data protection