Combinations and Competition: Why the draft DCB must account for digital mergers and acquisitions

Authored by Abhineet Nayyar and Isha Suri, reviewed by Nishant

“It is better to buy than to compete”

Mark Zuckerberg (Meta CEO, 2008)[1]

Mergers and Acquisitions (collectively, M&As or Combinations) have been a common practice in industry consolidation for many years now. In fact, as Zuckerberg’s infamous quote suggests, it might be one of the central pillars of today’s internet economy. The recently announced $1.5 billion merger between Reliance Industries and Disney, which, among other things, aims to combine their streaming services – Jio Platforms and Hotstar, respectively – is just another instance of this growing trend.[2] Data on market activity suggests that far from being an outlier, M&As are becoming commonplace in the Indian technology ecosystem as well - a trend likely to continue and increase unless market regulators intervene.

Built on direct and indirect network effects, digital markets are susceptible to concentration in the hands of a few dominant platforms. In addition to potentially anti-competitive practices that these platforms are likely to engage in such as deep discounting, they often use ‘strategic investments and partnerships’ with their competitors or other firms in their supply chains to further consolidate their position in the market. Examples include but are not limited to Facebook’s 2012 acquisition of Instagram for $1 billion, its 2014 acquisition of WhatsApp for $19 billion, or even its 2020 investment of $5.7 billion in Reliance Industries’ Jio – a partnership that positions itself at “bringing together JioMart, Jio’s small-business initiative, with WhatsApp”.[3][4][5][6] Through similar transactions, dominant players are in a position to foreclose competition and further entrench their position as market leaders.

In 2022, the Parliamentary Standing Committee on “Anti-Competitive Practices by BigTech Companies” also highlighted ‘killer acquisitions’ in India’s digital markets as one of the many concerning anti-competitive practices.[7] As per the Standing Committee, in the choice between ‘Build versus Buy’, “large platforms tend to pick the latter, thereby disallowing smaller firms to grow beyond a certain limit.” [8] However, the Committee on Digital Competition Law (CDCL), specifically formed to look into competition-related concerns in digital markets, chose to exclude this particular anti-competitive practice from the ambit of its proposed Digital Competition Bill (Draft DCB). Moreover, the CDCL explains this choice by pointing to the Competition [Amendment] Act, 2023, which theoretically allows the Competition Commission of India (CCI) to review more M&As.

But this justification is only partial.[9] While the 2023 Amendment tries to answer the question “Are the right digital M&As being regulated by CCI?”, it ignores the more pertinent “Are the right principles being deployed to review digital M&As?”.

In this context, the first section of this article provides an overview of conventional M&A regulation in India and underlines prominent trends in the process. This is followed by an inquiry into the evolution of digital combinations in India, and their treatment by CCI. We conclude the piece by recommending CCI incorporate more accurate and relevant theories of harm for digital mergers – a practice that competition authorities have incorporated in other jurisdictions such as the EU’s Digital Markets Act, the UK’s Digital Markets, Competition and Consumers Bill and the 2022 guidelines released by Singapore’s Competition and Consumer Commission.[10]

Reviewing Combinations for Anti-competitiveness

M&As, including digital mergers, are governed through Sections 5 and 6 of the Competition Act, 2002 [Act] and the Combination Regulations, 2011. The Act lays out many key elements in this respect, including defining ‘Combinations’ - referred to a sub-group of M&As that qualify certain threshold values and are required to notify CCI about their existence.[11] In addition, the Act also empowers the CCI to evaluate and adjudicate on these combinations.[12]

Typically, a qualified combination – including a merger, an acquisition, or an investment that meets the threshold criteria – must notify the CCI of the relevant transaction.[13] Following this notification, as per the rules, the Commission conducts a thorough review of the anti-competitive effects of the proposed combinations. Once complete, the CCI is empowered to either approve or reject the transaction. Overall, the CCI primarily assesses the combination based on its effect on the competition structure of the relevant market. In cases where the CCI is satisfied that such adverse effects can be eliminated by suitable modification, it may approve the combination with modifications. Conversely, the Commission might also pursue an investigation against a combination that has failed to notify it of the relevant transaction.

It is important to note that not every M&A requires notification and approval from the Commission and depends on whether that particular transaction qualifies the threshold values set under Section 5 of the Act.[14] With massive digitisation underway across all sectors of the Indian economy, concerns about how these threshold values affect scrutiny of digital mergers – which usually didn’t qualify – have drawn focus in recent years.[15] Deals such as Facebook’s 2014 acquisition of WhatsApp, which evaded the regulator’s scrutiny since it failed to meet the qualifying thresholds, have also uncovered the need for newer ‘theories of harm’ that can be used to govern such combinations adequately [more on this later].[16]

Digital M&As and Limitations of the Status Quo

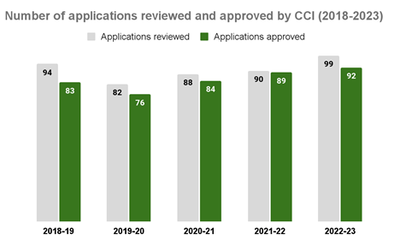

According to data released by CCI in its annual reports, the Commission reviewed 99 combination notices in 2022-23, an increase from 90 during the previous year.[17] Out of these 99, the Commission approved 92 such combinations in 2022-23, up from 89 in 2021-22.[18] However, it is pertinent to note that none of these combination notices were rejected by the Commission. In fact, CCI has not rejected any of the 400+ combination notices filed with it in the last five years.[19]

Furthermore, research undertaken by Deloitte suggests that there were more than 160 mergers or acquisitions in India in 2022-23.[20] This disparity between CCI’s figures and market estimates can largely be attributed to the threshold requirements under the 2002 Act. Taking into account that over 36% of these 160+ M&A deals are estimated to be in the ‘Technology, Media and Telecommunications’ industry, it is reasonable to assume that ‘asset-light’ digital combinations continue to escape the Commission’s scrutiny.[21] This is a risk because despite failing to meet the threshold values set under the 2002 Act, many deals are still significant in their scale. For example, Reliance Industries group, which also owns the telecom giant Jio, single-handedly accounted for eight (8) digital acquisitions in 2019.[22]

The Commission’s high approval rate, coupled with its inability to appropriately scrutinise such digital M&As, led to the government seeking modifications to India’s competition law.[23] In 2023, following the recommendations of the 2019 Competition Law Review Committee, the Competition (Amendment) Act, 2023 [or ‘the 2023 Amendment’] was passed.[24] Among other changes, the 2023 Amendment included “value of transaction” as one of the threshold measures for triggering the notifying clause.[25] This meant that even if a merger did not satisfy the ‘asset’ or ‘turnover’ threshold values, it could still be deemed a combination if the value of the transaction exceeded ₹2000 cr.[26] However, the impact of the 2023 Amendment on CCI’s future rulings is yet to be seen.

Thereafter in 2023, the Government of India constituted the CDCL “to examine the need for a separate law on competition in digital markets”, including a framework similar to the EU’s Digital Markets Act.[27][28] However, unlike the US, the EU, the UK, or Singapore – jurisdictions that the CDCL referred to during its deliberations – it explicitly excluded ‘mergers and acquisitions’ from the draft bill’s scope, instead relying solely on the 2023 Amendment.[29] But the intended objectives of the 2023 Amendment and the proposed DCB are entirely different. While deal value thresholds aim to address the ‘threshold value’ problem to include more deals under merger review, they provide no guidance that can help adapt the merger review process to the context of digital markets.

Adopting Accurate and Relevant Theories of Harm

Established theories of harm lie at the core of any merger review process, with the competition regulator relying on them to assess potential damage to competition. Traditionally, if merging parties are neither competitors (horizontal) nor trading relationships (vertical), their combinations are usually not subject to strict enforcement under the conventional merger review regime.[30][31] As a result, traditional theories of harm focus on the risk that the post-merger firm will ‘bundle’ or ‘tie’ the pre-merger firms’ products together. In contrast, many inherent characteristics of digital markets – such as network effects and low marginal costs – have been found to exacerbate the gaps in these outdated theories of harm.[32][33] While network effects allow first movers to access a positive feedback loop and become dominant in digital markets, they also incentivise mergers between competitors because an increase in the network of users is likely to generate further returns.[34]

Take the case of ‘platform envelopment’, for example, where a platform dominant in one market i.e., ‘the origin market’, enters another platform market i.e., ‘the target market’ – through a merger or an acquisition – and bundles its original functionality with that of its newly acquired platform in the target market.[35] As a prominent example of this theory, Google entered mobile operating systems by bundling Android with Google Search – two separate markets – to leverage the data generated by users of both. Such data was effectively monetized through Google’s online advertising platforms, thereby enabling the firm to fund its entry in a way that could not be replicated by other competitors and contributed to its eventual dominance of the mobile operating system market.[36] However, recognising envelopment and using other such theories of harm requires an understanding of platform characteristics, the impact of direct and indirect network effects, and the role of data in enabling platform monopolisation – all of which the draft DCB seeks to do.[37]

As highlighted earlier, many other jurisdictions have also updated or are in the process of updating their merger guidelines to incorporate these newer theories of harm. For instance, the Japan Fair Trade Commission (JFTC) amended its merger guidelines in 2019 to address the competitive concerns of conglomerate mergers, especially in digital markets. This allows the JFTC to consider factors such as network effects, the value of data, and the importance of marginal costs while reviewing digital combinations.[38]

With M&A activity in India’s digital sector also bound to witness an upward trend, we reiterate that merger review for digital markets should account for many of these characteristics that are likely to amplify the shortcomings of traditional theories of harm. This requires the CDCL to modify the draft DCB accordingly or, at the very least, for the CCI to publish detailed guidelines on reviewing digital M&As, accounting for more evolved theories of harm.

[1]FTC v. Facebook, Inc, FTC Amended Complaint, 2021, p. 1, available here

[2]Reliance and Disney team up to crush Netflix and Prime Video in India, Rest of World, March 2024, available here

[3]The Inside Story of How Facebook Acquired Instagram, OneZero, August 2020, available here

[4]India seeks to tighten rules on M&A antitrust scrutiny, Reuters, 2022, available here

[5]CCI approves acquisition of approximately 9.99% of Jio Platforms by Facebook, AZB and Partners, 2020, available here

[6]Facebook Invests $5.7 Billion in Indian Internet Giant Jio, The New York Times, April 2020, available here

[7]Parliamentary Standing Committee on Anti-Competitive Practices by BigTech Companies, Ministry of Corporate Affairs, p. 8, available here

[8]Parliamentary Standing Committee on Anti-Competitive Practices by BigTech Companies, Ministry of Corporate Affairs, p. 8, available here

[9]Comments to the Draft Digital Competition Bill, 2024, Nayyar, A., Suri, I., and Bedi, P., Centre for Internet and Society, May 2024, p. 20-22, available here

[10]Singapore: Competition law fact sheet, Norton Rose Fulbright, April 2024, available here

[11]The Competition Act, 2002, Government of India, p. 8, available here

[12]The Competition Act, 2002, Government of India, p. 12, available here

[13]Combination FAQs, Competition Commission of India, available here

[14]The Competition Act, 2002, Government of India, p. 8, available here

[15]Big Data Mergers: Bridging the Gap for an Effective Merger Control Framework, Tyagi, K., May 2021, p. 34, available here

[16]India seeks to tighten rules on M&A antitrust scrutiny, Reuters, 2022, available here

[17]Annual Reports, Competition Commission of India, available here

[18]Annual Reports, Competition Commission of India, available here

[19]Annual Reports, Competition Commission of India, available here

[20]India’s M&A Trends 2023, Deloitte, 2023, available here

[21]India’s M&A Trends 2023, Deloitte, 2023, available here

[22]2019 In Review: Top 10 High-Profile Startup Acquisitions In India, Inc42, 2019, available here

[23]India seeks to tighten rules on M&A antitrust scrutiny, Reuters, 2022, available here

[24]The Competition (Amendment) Act, 2023, Government of India, available here

[25]The Competition (Amendment) Act, 2023, Government of India, available here

[26]The Competition (Amendment) Act, 2023, Government of India, available here

[27]Unstarred question No. 81, Government of India, Lok Sabha, December 2023, available here

[28]The Digital Markets Act Proposal of the European Commission: Ex-ante Regulation, Infused with Competition Principles, European Papers, 2021, available here

[29]Report of the Committee on Digital Competition Law, Government of India, 2024, p. 151 onwards, available here

[30]A note on conglomerate mergers: The Google/Fitbit case, Nakagawa, K. and Matsushima, N., Japan and the World Economy, Volume 67, 2023, 101203, ISSN 0922-1425, available here

[31]Executive Summary of the Roundtable on Conglomerate effects of mergers, OECD, June 2020, available here

[32]Executive Summary of the Roundtable on Conglomerate effects of mergers, OECD, June 2020, available here

[33]Tying and bundling in the digital era, Holzweber, S., European Competition Journal, October 2018, available here

[34]Horizontal mergers, cost savings, and network effects, Cosnita-Langlias, A. and Rasch, A., Bulletin of Economic Research, April 2018, available here

[35]Harnessing Platform Envelopment in the Digital World, Condorelli, Daniele; Padilla, Jorge, Journal of Competition Law & Economics, 00(00), 1-45, 2020, available here

[36] Harnessing Platform Envelopment in the Digital World, Condorelli, Daniele; Padilla, Jorge, Journal of Competition Law & Economics, 00(00), 1-45, 2020, available here

[37]Summary of Discussion of the roundtable on Conglomerate Effects of Mergers, OECD, Feb 2021, available here

[38]Conglomerate effects of mergers – Note by Japan, OECD, May 2020, available here